The German DiGA Market from the Investor’s Perspective

Part 2: Commercial Challenges of the DiGA Business Model

As part 1 of the blog series illustrates, total Rx/Revenue volume for individual DiGAs did not go through the roof in contradiction to early predictions of e.g. consultancies or investors. Even the market leader zanadio “only” achieved 28k Rx in the third year on the market which equates to 6,1 mio gross revenue (as for all DiGAs the negotiated price of 218 € includes VAT). The aidhere (manufacturer of zanadio) website stated that during the same time period the company had +150 employees, so even if this is not equivalent to 150 FTEs it is quite obvious that the Rx volume market leader must have been far away from profitability with this level of labour cost.

So what makes commercializing DiGAs successfully (=profitable) so difficult?

I would distinguish between three major pillars:

- Factors you can influence: Company Set-up

- Factors you can deal with: Market Conditions

- Factors you can’t do anything about: Regulatory Framework

Factors you can influence: Company Set-up

Team/Culture

Most founder teams of DiGA companies consist of Medical Doctors and/or Software Developers, very rarely you will find someone with a commercial background, e.g. from a leading consultancy or with relevant sales/marketing experience in the healthcare/pharma space.

The therapeutic and technical expertise is a great combination to develop a Digital Health product and to convince investors. However for most DiGA manufacturers it turned out that this founder team composition was a major challenge in developing and deploying a successful Go to Market strategy, simply because none of them ever launched a prescription product in a highly regulated market.

In theory this could have easily been addressed by the right hiring strategy but most DiGA manufacturers thought that they “have a digital product and will market it primarily digitally”. So they hired sales and marketing leaders with a D2C/performance marketing and/or SaaS background instead of B2B/healthcare/pharma experts. A questionable strategy if B2B/HCP is the dominant sales channel and it took most of the DiGA companies a long time to realize that they need to adopt pharma sales and marketing tactics, e.g. deploy DiGA sales reps. And still today many of the DiGA manufacturers are still at an early stage of their learning curve with regards to operational excellence in sales and marketing.

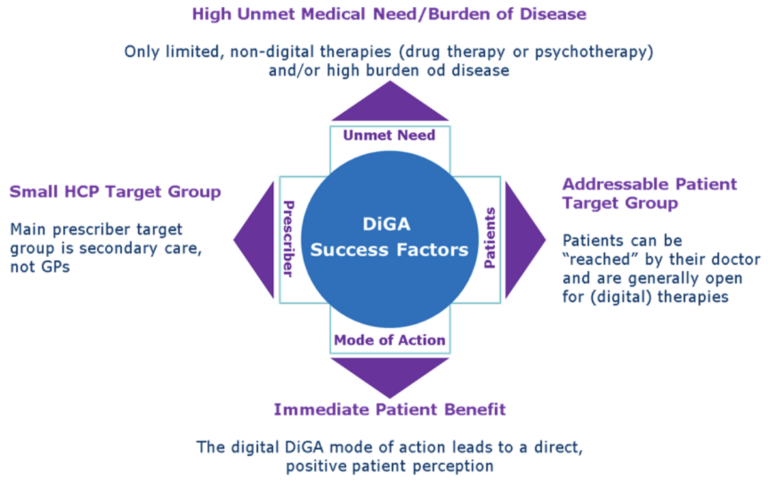

Indication in scope

Making the right portfolio decision is crucial for commercial success, four therapeutic area related parameters can be identified to predict the commercial potential of a DiGA:

Two examples illustrate the implications:

Indication with good commercial potential: Overactive Bladder in women (multiple DiGAs are in development for this indication)

There are only limited drug therapies available, most of them have side effects and overactive bladder is associated with a significant reduction in quality of life, the main prescribers are Gynaecologists/Urologists, women as a patient target group are main users of digital therapy and as the reason for OA is a miscommunication between bladder and brain, digital behavioural therapy works very well in this indication.

Indication with commercial challenges: High Blood Pressure (only one DiGA on the market)

There are many, cheap and efficient drug therapies available, most patients do not even experience any symptoms from mild to moderate high blood pressure, main prescribers are GPs, patients are often male and “mode of action” is support of long term life style change with very limited short term effects.

From a resource allocation perspective, thorough indication assessment is completely underrated in the entire DiGA market, a lot of money is wasted in bringing commercially unattractive indications to the market.

Factors you can deal with: Market Conditions

Low “Carry Over” for DiGAs

With an average of only 13% of all DiGA Rx being repeat prescriptions for the same patient (actual repeat Rx numbers vary between low single digit percentages e.g. for many mental health DiGAs and a max of 37% for zanadio/obesity), it is obvious that DiGA revenue and growth can only come from NEW patients which explains high sales and marketing cost in order to deliver Rx growth.

As a comparison: in typical chronic conditions (e.g. high blood pressure or diabetes) for pharma products with ongoing repeat prescriptions the Carry Over (revenue that would be generated in the next period without any sales activity) is between 80% and 90%, so pharma sales can concentrate on generating incremental sales. The aforementioned tendency of most DiGA manufacturers to allocate too much resources to DTC/Direct to Patient channels has a negative effect on profitability because B2C Customer Acquisition Cost are higher and show little economies of scale compared to B2B/HCP sales. Of course there are strategic opportunities in therapeutic area coverage, product design and positioning to increase the Rx repeat prescription share and thus reduce the cost pressure from new customer acquisition, the room for improvement is unfortunately limited here. The biggest lever however is the development and execution of a highly targeted sales and marketing strategy maximizing the output and optimizing the ROI.

Competitive situation

Typically the “First to Market” DiGA captures the majority of the market share. Second or third in an indication did by far not reach the Rx levels of the market leader. Explanations could be:

- Typically very little differentiation between the DiGAs in the same indication and any new DiGA is perceived as a “Me too” because there is only little room for real innovation (e.g. “mode of action”) when DiGAs follow Medical Guidelines where cognitive behavioural therapy is often the first line treatment and the CBT principles are then transferred into a digital application

- As a consequence of the approval process, launches with market entry +12 months after the first launch are more expensive (preliminary listing with higher, manufacturer set price in the first 12 months) compared to the permanently listed market leader with a lower negotiated price after the first 12 months. Although prescribing a DiGA does not count against an HCPs budget, many doctors still look at DiGA prices as a reference point for their prescribing decision

- Permanently listed market leaders have provided full clinical evidence already whereas new competitors typically launch with preliminary listing and “weaker” clinical evidence

- DiGA “Early Adopters” in the HCP universe already developed into loyal prescribers of the “First to market” DiGA if their experience was positive or in case DiGA outcome/patient feedback wasn’t favorable it is significantly more difficult to convince them to try a “new” DiGA

Understanding the consequences of these market dynamics is the basis for the development of an efficient market entry strategy for a “second to market” product.

Factors you can’t do anything about: Regulatory Framework

Prescription process

The German DiGA legislation has many positive aspects, the prescription process however is overcomplicated and leads to many inefficiencies. If a doctor prescribes a DiGA, the patient receives a paper script which he has to submit to his health insurance, then the health insurance issues an activation code and sends this to the patient by letter post (!) which used to take up to two weeks (now the health insurances are obliged to provide the activation code within two days). Only with this activation code the patient can then start his digital therapy. This process leads to a massive loss of 30% to over 50% of Rx converting into actual therapy starts which are the basis for reimbursement. With the introduction of the electronic health record and the electronic prescription in Germany this could improve, however the initial technical concept developed by gematik (German National Agency for Digital Medicine) for a new prescription process does not look very promising.

Upcoming regulatory changes

One of the major regulatory changes with direct commercial impact that will come into effect 1.1.2026 is the introduction of an “Accompanying Success Measurement” component. Based on the „Act to Accelerate the Digitalization of Healthcare“ (Digital-Gesetz – DigiG), DiGA manufacturers will need to conduct an Accompanying Success Measurement, the results of which will be regularly published in the DiGA directory. Key metrics include:

- Duration and frequency of use of DiGA

- Patient satisfaction regarding the quality of DiGA

- Patient-reported health status during the use of DiGA

Detailed provisions on data submission deadlines, methods, processes, and content of the success measurement, as well as on publication in the DiGA directory, are to be regulated in an upcoming amendment to the DiGA Ordinance (DiGAV).

Most importantly: at least 20% of the final reimbursement price will be based on the results of the success measurement. This can be a significant revenue risk for the DiGA providers depending on the final results of the negotiations on the exact terms for the introduction of the Accompanying Success Measurement framework between the National Association of Statutory Health Insurance Funds and the Associations representing the DiGA manufacturers.

If you want to stay updated on Angel Investing in HealthTech at MEDKAP, please

- subscribe to our newsletter

- subscribe to our LinkedIn page.