Get funding from HealthTech experts

How we operate

MEDKAP is a non-profit association and does not invest itself. We connect startups and investors.

Investors must be members of the association and comply with our Code of Conduct. For each funding round we have a dedicated deal manager who represents the interests of the investors on your cap table and manages the syndicate. We do not require board seats, but in certain cases the expertise of our members may be beneficial. We do not expect liquidation preferences of more than one, and expect your other investors to not seek higher liquidation preferences.

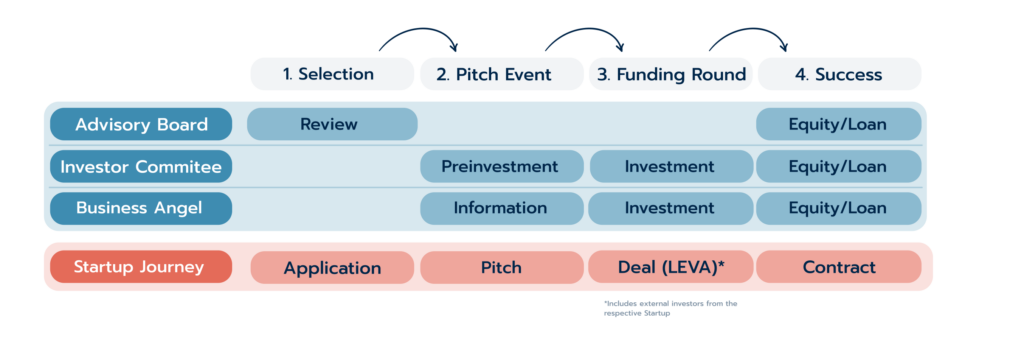

The investment process

Selection

- Submit your application

- First contact and confirmation or rejection

- Advisory Board Review (Feedback 2-3 weeks)

Pitch Event (invitation based on Jury rating)

- Deal setup (based on Investor interest during pitch event).*

- Onboarding of first investors to reach minimum investment amount (CHF 50’000)

Funding Round

- Deal announcement to MEDKAP members

- Soft commitment phase, 2 weeks

- Deep dive call

- Hard commitment phase, 2 weeks

Success

- Deal closing

*The deal manager may be the lead investor or the KAPSLY GmbH by default.

Location

- DACH Region

Verticals

- Digital Health

- Medical technology

- Diagnostics

Stage

Pre-seed to Series A with a lead investor

Purpose

Commercialisation, Industrialisation, Product development, Quality management, Regulatory affairs

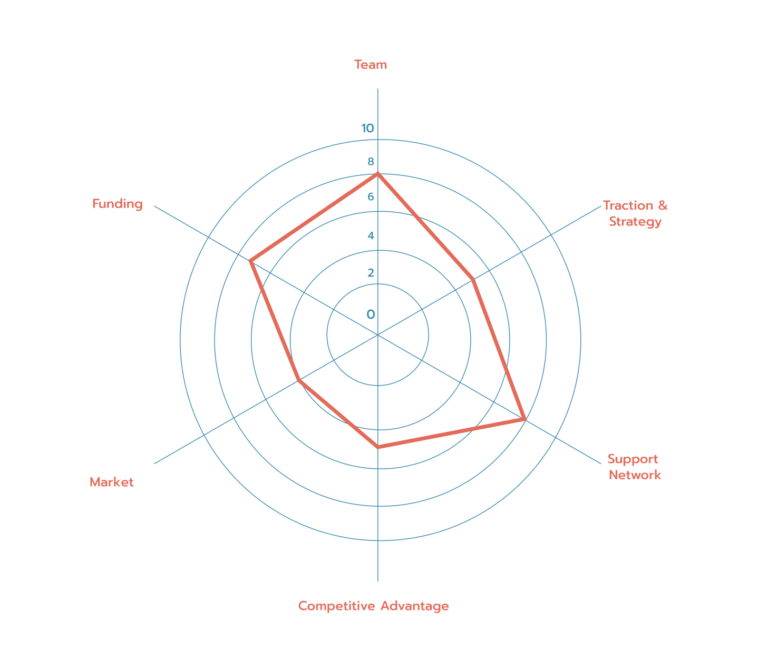

Evaluation criteria

- Team

- Traction

- Competitive Advantage

- Support Network

- Market

- Funding

Jury Score

The following information is required for the application

Service for Equity

KAPSLY Ventures Service Partners

Explore the exclusive network of KAPSLY Ventures Service Partners available on our platform. These experts, ranging from legal advisors to marketing strategists, are committed to guiding startups with tailored support.

Benefit from their experience in areas crucial to startups’ growth, such as legal, financial, and marketing. Connect with our Service Partners on KAPSLY Ventures to access invaluable insights and propel your startup towards success.

KAPSLY Info Session

Join the Session for insights on the Swiss HealthTech ecosystem, the current funding environment, and the importance of commercialisation.

Frequently Asked Questions

A syndicate is a group of investors who have a common interest and act as one partnership to invest in a e.g. startup.

Hence, a syndicate acts as one investor.

The money goes directly to the startup that you selected to invest in. A more detailed allocation of the money will be provided by the startups, respectively.

We are looking for experienced entrepreneurs and business angels who can provide additional value to our startups, especially in the healthtech sector. In general the syndicate is open to anyone who wants to invest in healthtech startups. Simply join our investment newsletter and receive selected deals to your inbox for free.

Basic Membership: 240.- per year

Gold Membership: 1200.- per year

Enterprises: 5000.- per year

The yearly membership fee to join the MEDKAP Community for 2023 is CHF 100.-.

With the syndicate you get access to our venture studio community and receive a deal flow without scouting for startups yourself. The non-profit association MEDKAP takes care of negotiating term deals and performing due diligence, and setting up the contracts. Additionally, the capital efficiency is higher due to our service partners that have supported startups many times.

The minimum investment amount per deal is CHF 5’000 and the deal only gets completed if over CHF 50´000 are invested.

Yes, your name will not be shared with other investors or the startup automatically.

Your name will not appear on the cap table of the startup either. However, we encourage our investors to get in touch with the founders.

Yes, it is possible to transfer your stake to another investor in a secondary transaction. The deal manager must be informed and needs to approve the transaction.

For every deal a new simple partnership is formed through a legal contract amongst the syndicate investors.

For more information please contact MEDKAP.

After clicking on “join us” and having completed the form, you receive deals straight to your inbox.

You make your own investment decisions on a deal by deal basis, usually within two weeks after receiving the investment memo.

You can find additional details regarding platform and usage in the application form.