The German DiGA Market from the Investor’s Perspective

Part 1: Introduction and Status Quo of the DiGA Market in Germany

September 2020 marked a turning point for the commercialization of Digital Health in Germany…and worldwide. The first fully reimbursed Digital Health Applications (DiGA: Digitale Gesundheitsanwendungen) were launched in Germany based on the Digital Healthcare Act (DVG) and Digital Health Applications Ordinance (DiGAV). Meanwhile several countries like Belgium, France or Austria used the German legislation as a blueprint and introduced or announced similar Digital Health initiatives.

For the first time Digital Health providers (and investors) saw the opportunity to bring innovative digital solutions to the market that are paid for by the national statutory health insurance system raising the expectation of steady and growing revenue streams just like for pharmaceutical products.

Let’s take a closer look at the evolution of the DiGA market in Germany and what remained of the gold rush atmosphere.

What exactly is a DiGA?

A DiGA is a CE-marked medical device that has the following properties:

- Medical device of the risk class I or IIa/b (according to the Medical Device Regulation (MDR) or the transitional regulation Medical Device Directive (MDD)).

- The main function of the DiGA is based on digital technologies.

- The medical purpose is mainly achieved by way of its digital function.

- The DiGA supports the recognition, monitoring, treatment or alleviation of diseases or the recognition, treatment, alleviation or compensation of injuries or disabilities.

- The DiGA is used by the patient alone or by patient and healthcare provider together.

How does the assessment/approval process work?

The procedure is designed as a “fast-track” process: Within a three-month period (in theory) at the most, starting with the filing of the complete application, the German BfArM (Federal Institute for Drugs and Medical Devices) has to assess the DiGA taking into consideration requirements regarding:

- Security

- Functionality

- Quality

- Data protection

- Data security

- Interoperability

The DiGA manufacturers also need to document the (potential) Positive Care Effects of the Digital Health Application, e.g. medical benefits or structural and procedural improvements. This is typically done through a small clinical study.

Following a positive BfArM assessment of the DiGA application, a Preliminary Admission into the DiGA Directory according to §139e SGB V is granted for 12 months and the DiGA can be prescribed by HCPs and will be reimbursed. During these 12 months DiGA manufacturers are then obliged to conduct a larger scale clinical study to generate sufficient clinical evidence confirming the intended Positive Care Effect in order to achieve Permanent Admission into the DiGA Directory.

The DiGA price for the first 12 months can be set by the manufacturer, however for many therapeutic areas maximum price rules apply. Once the clinical evidence is accepted and Permanent Admission is granted, DiGA manufacturers have to engage in price negotiations with the National Association of Statutory Health Insurance Funds and if they can’t agree on a price, an arbitration process will be initiated resulting in the final reimbursed price.

The DiGA Landscape in a nutshell

- Most DiGA are mobile applications and are often based on cognitive behavioural therapy

- DiGA cover a large variety of indications with mental health/neuro/psych being the most crowded therapy area

- Currently (23/09/2024) 55 DiGA are listed in the DiGA Directory (https://diga.bfarm.de/de/verzeichnis), 35 permanently listed and 20 with a preliminary listing

- HelloBetter, Selfapy, Gaia have successfully launched multiple DiGA, other manufacturers are currently a one or two product company, some of them with a solid product development roadmap

- 3 months are the standard treatment period covered by one prescription, repeat prescriptions are possible (across all DiGA only 13% of all Rx are repeat Rx)

- The average price for the first 12 months is 529 €, average negotiated price level after 12 months however is significantly lower at 221 €

- On average 89% of all DiGA are prescribed by doctors, 11% are directly applied for by patients with their health insurance making the “B2B/HCP” sales channel the dominating Go to Market approach

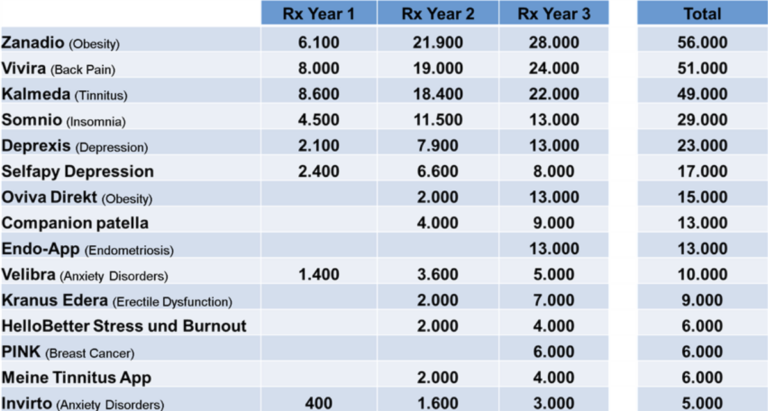

- DiGAs with accumulated Rx Volume >5.000 over 3 years (Sept 2020-Sept 2023):

The “Macro-Environment” for DiGA in Germany

Taking a closer look at the sentiment of key stakeholder groups towards DiGA I would come to the conclusion that despite the initial hype from investors and manufacturers, Patients, Prescribers and Payors overall are more “realistic” respectively neutral to slightly negative. The vast majority of patients simply are not aware of DiGA as a treatment option for specific indications. The awareness among Prescribers improves slowly over time, HCPs however complain about comparatively high DiGA prices, limited value for patients and little monetary compensation for the additional time and effort required to educate patients about DiGA, prescribe them and follow up with patients. The majority of Payors also criticizes the pricing policy of DiGA manufacturers and low clinical evidence requirements.

Overall the availability of DiGA (respectively digital therapies in general) as a therapy option is still perceived as a positive development, however major cornerstones of the DiGA regulatory framework (pricing and clinical evidence requirements) are seen very controversial within major stakeholder groups creating some political/regulatory headwind for the DiGA industry.

If you want to stay updated on Angel Investing in HealthTech at MEDKAP, please

- subscribe to our newsletter

- subscribe to our LinkedIn page.