Corporate Innovation Overview: When to Build, Buy, Partner, or Invest: Navigating MedTech Innovation

In today’s fast-paced tech world, MedTech corporates must innovate to stay on top of the S-Curve — or, even better, to kickstart the next one. This concept, influenced by Schumpeter and developed by McKinsey, highlights the need for innovation while you still have a strong market share and healthy margins. With innovation cycles getting shorter and new technologies like AI and quantum computing accelerating these trends, it’s evident that many large MedTech companies need to look beyond their R&D departments to keep their edge.

Here, we’ll compare internal R&D with three other strategies and identify which model works best, depending on the circumstances.

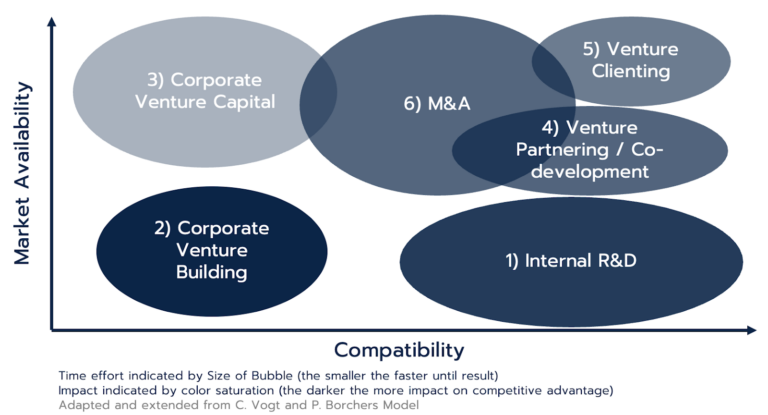

The following chart recommends different ways to bring in corporate innovation based on whether this innovation is available on the market and how compatible it is with the current organisation. We will go through each activity starting with internal research and development as the base case. The larger the bubble the longer it takes from initiation to see results (i.e. generating more revenue, financial returns or cost savings). The darker the color is, the bigger the potential impact on the innovation S-curve.

1. Internal R&D: The Core Competency Approach

If there’s an innovation that doesn’t exist in the market and your company has the core competencies to develop it, then internal R&D is your go-to. Sure, there’s a trend towards external innovation and most R&D projects focus on incremental innovation, but it’s crucial not to abandon your internal capabilities. We support fostering external innovation from startups, but we’re also big advocates of maintaining robust internal R&D resources. We don’t want R&D engineers to become just paper pushers for documentation and design tweaks.

2. Corporate Venture Building: Innovate Outside the Box

Venture building is a fantastic option if you want to create disruptive innovation outside of corporate red tape. With a new, agile team, you can develop a novel product or enter a new market. It’s essential that the company holds the majority of shares, but also offer the project team and future senior management some equity to attract the right entrepreneurial talent. Such projects are certainly not easy and require very professional and lean approaches. In many cases projects must be canceled, something corporates are not very used to and the project team has conflicts of interest to make such a proposal as their job depends on the project. This often leads to wasting too much time and capital. These risks must be managed accordingly. Venture Building has been perceived as a secret weapon of corporates to compete with the startup world, just with better funded startups and a better ecosystem. However, expectations and processes must still be set from the beginning and those things don’t happen overnight. Acting like a startup also requires a lot of validation, many unknown hypothesis and market players. Such things take time and require patience.

3. Corporate Venture Capital (CVC): Stay Connected

CVC is a great way for companies to keep a finger on the pulse of innovation by engaging with startups early on. However, as a financial activity, most CVC funds are incentivized financially. Taking minority stakes doesn’t necessarily provide competitive advantages; it’s more about generating financial returns. Acquiring startups is an option, but it can lead to conflicts of interest between maximizing returns for the CVC and acquiring cheaply for the parent company. Supposedly, less than 10% of CVC-funded startups get acquired by their parent company. Does that mean CVC fails? Not necessarily — it depends on your objectives. Financial returns alone are a good outcome; anything else is a bonus.

4. Venture Partnering: Direct Competitive Advantage

We are now moving to the top right of the chart. In the original there was only one bubble “Corporate-Startup Partnering” which I have separated into Venture Partnering and Venture Clienting.

Venture Partnering is the activity where a startup and the corporate work together on a joint development project with the aim to create new competitive advantages for the corporate, while the startups benefits form resources such as capital, know-how and market access. This approach requires a lot of legal oversight, project coordination and R&D resources. The complexity here quickly becomes obvious, such as IP and ownership topics. Often such developments are done exclusively, so the danger for the startups may be to be downgraded to a service provider and lose the large upside of a scaleup. However, this may be an early step into creating a Joint Venture.

5. Venture Clienting: Quick Results at Low Risk

Venture Clienting is the newest approach of Open Innovation where you specifically scout for startup solutions that solve a real challenge for your company. The goal is to quickly and cheaply assess the collaboration success through paid pilot projects. It’s crucial to have clear problem specifications and resource allocations. The identification of innovation challenges can either be developed top-down, by identifying (resource or know-how) gaps in your innovation strategy, or bottom-up from the business units who bring up challenges they cannot solve internally. One challenge for corporates is often to establish processes, responsibilities and budgets that allow them to start a pilot within three months. Startups may literally die from the bureaucratic and timely supplier approval process at corporates. Sometimes expectation of a corporate and a startup can be diametrically different. Hence it is useful to have a mediator who understands both worlds. Venture Clienting is also a great way to establish a market overview. You might find out that the solution you were looking for does not exist in the market, this is a great indication to revert to venture building.

6. M&A: The Last Resort

I mention M&A as last resort on purpose, because ideally it does not lead the activities but is the result of successful collaborations before. One of the biggest risks in M&A is that the post merger integration does not work as planned. With Venture Clienting and Partnering you can turn that around and do a pre-merger-integration. Quickly you will find out how compatible their solution is to your process and products and naturally deepen the partnership over time. An acquisition may also be the result of a great CVC investment, but as mentioned, this is also rather rare.

The Ideal Strategy: Flexibility and Adaptation

Starting with a corporate-startup partnering mindset as your first step, provides many benefits by giving you a good market overview and allowing you to make educated decisions about which innovation is actually most suitable. If needed, shift to investing, venture building with an external team, or internal R&D. From an M&A perspective, it allows you to test the compatibility and build a partnership before committing to long and costly due diligence processes, mitigating post-merger integration risks.

At KAPSLY and MEDKAP, we offer the right ecosystem for MedTech corporates to benefit from startup innovation. Whether it’s through Venture Clienting, Venture Building, or strategic investments, we can help you stay at the forefront of HealthTech innovation. Let’s connect and explore how we can support your strategic goals.

If you want to stay updated on Angel Investing in HealthTech at MEDKAP, please

- subscribe to our newsletter

- subscribe to our LinkedIn page.