Fuel the Future of Healthcare

Invest in the most promising HealthTech Startups and play a key role in shaping the future of healthcare by becoming a part of our Investor Network.

MEDKAP is a Swiss non-profit association for private & institutional investors.

We identify high-potential early-stage startups in the fields of digital health, medtech and diagnostics (HealthTech) and enable our members to build diversified portfolios.

We encourage best-of-breed approaches to bring the startup quicker to success.

Why you should join us

We are a network of people that shape the future. Help HealthTech startups implementing their break-through technologies and take part in their story – and their success.

HealthTech, and only HealthTech

If you’re a pro in this topic or have an interest in it, we’re the right partner for you: We find and present the best HealthTech startups in the D-A-CH region.

Maximise success

We make sure that the company works with professional, specialized partners to accelerate their development and increase their chances of success.

Diversification with a limited budget

The minimum investment in a startup is CHF >5’000, so you can make regular investments and build a diversified startup portfolio. We work with an organization that provides investment pooling services.

Simple processes

We work with partners that automate and digitize as many processes as possible. That means more time for looking into new cases and less time for doing administrative tasks related to your investments.

Info Session

For New Members

Join the Session to learn more about our Membership as Private or Institutional Investor and meet us personally.

Stay up to date on MEDKAP activities and gain investment insights

The HealthTech Investor Playbook

- industry insights from leading experts

- smart investment strategies for business angels

- understanding of the Swiss HealthTech Funding environment

MEDKAP Membership Packages

Investor Type

Annual Fee

Dealflow Access

Investment Mode

Event Access

Branding

Private Members

Healthcare executives and industry professionals

CHF 990 (CHF 495 for invited or active)

Curated startup pipeline

Syndicated (active/passive choice)

Access to Pitchevents +1 guest

–

Institutional Investors

Family Offices and Venture Capital firms

From CHF 5,000 (incl. 3 seats)

Full dealflow access + historic data + jury reviews

Direct investments or via syndicates

Access and co-hosting options

Logo visibility on MEDKAP website and various communications

Corporates

MedTech and Diagnostic companies (from SMEs to large corporations)

From CHF 5,000 (incl. 3 seats)

Full dealflow access + historic data + jury reviews

Direct investments or via syndicates

Access and co-hosting options

Logo visibility on MEDKAP website and various communications

Membership: How does it work?

Your Role as an Investor

Join our regular pitchevents and express your investment interest on the selected cases.

You choose whether to invest, either passively or actively supporting the startup.

We offer learning and networking opportunities, alongside dealflow access.

Investments are typically syndicated, bundling small amounts into one larger investment.

Your participation is flexible: stay anonymous or take an active lead role.

How Startups Are Evaluated

Advisory Board: Screens and evaluates startups based on their potential, business model, and team. The board also offers guidance and helps coordinate investment pooling services.

Investment Committee: Reviews selected cases to assess risk and return potential. They lead a structured pre-investment roundtable to discuss findings and align next steps.

Domain Expert: For each selected case, we chose a dedicated member with subject matter expertise. The Domain Expert helps with the technical and commercial due diligence and leads the deep dive call.

Key Investment Information

Location

DACH Region

Verticals

Digital Health, Medical technology, Diagnostics, Techbio

Stage

Pre-seed to Seed

Purpose

Commercialisation, Clinical Studies, Product approval, Expansion …

Ticket size per investor:

CHF 5´000 – 150’000

Investment target per startup:

CHF 50´000 – 200’000

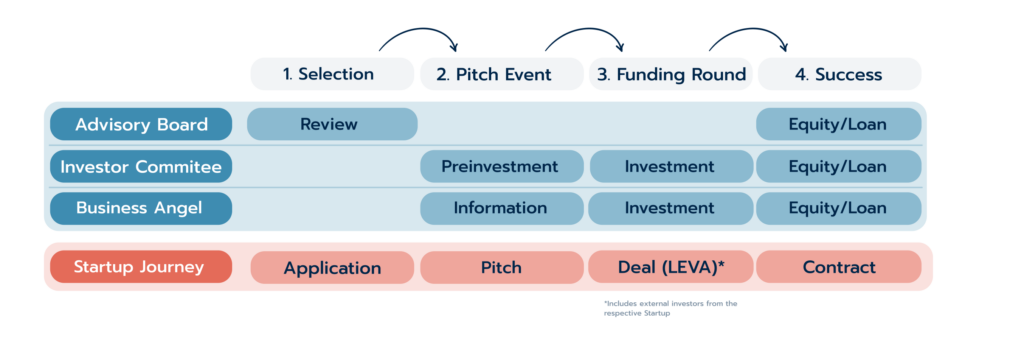

The investment process

Upcoming Pitch Events

Discover exciting startups and engage in discussions with fellow investors. These events are exclusive to members; please contact Vincent Irrling for an invitation. Here are our next opportunities to connect:

Pitch Event at Tenity: Wednesday, 11 March 2026 | 17:00 – 20:00

Pitch Event at FONGIT: Tuesday, 25 March 2026 | 17:00 – 20:00

Be part of it

- At MEDKAP you can invest in the most promising HealthTech Startups and play a key role in shaping the future of healthcare.

- Medtech companies can benefit from our dealflow, expert network and build strategic advantages with startup innovation.

FUEL THE FUTURE OF HEALTHCARE

Frequently Asked Questions

Syndicate

A syndicate is a group of investors who have a common interest and act as one partnership to invest in a e.g. startup.

Hence, a syndicate acts as one investor.

We are looking for experienced entrepreneurs, business angels and private investors who can provide additional value to our startups, especially in the HealthTech sector. In general the syndicate is open to anyone who wants to invest in HealthTech startups. Simply join our investment newsletter and receive selected deals to your inbox for free.

For every deal a new simple partnership is formed through a legal contract amongst the syndicate investors.

For more information please contact MEDKAP.

With the syndicate you get access to our venture studio community and receive a deal flow without scouting for startups yourself. The non-profit association MEDKAP takes care of negotiating term deals and performing due diligence, and setting up the contracts. Additionally, the capital efficiency is higher due to our service partners that have supported startups many times.

- Leaving MEDKAP: Your existing investments remain in place and continue to be managed.

- Leaving a syndicate: You would need to find a buyer for your position in that specific syndicate.

Membership

Private Membership: 990.- per year – 50% discount for invited prospects and active members (from 2nd year)

Enterprises: From 5000.- per year

For more information, please contact vincent@medkap.org

The membership fee covers the operational costs of running the association itself. There are no separate management or operational fees charged to individual members.

There are no geographic restrictions. Members can remain active regardless of where they are based.

Investments

The money goes directly to the startup that you selected to invest in. A more detailed allocation of the money will be provided by the startups, respectively.

The minimum investment amount per member is CHF 5’000 and the deal only gets completed if over CHF 50´000 is allocated jointly.

There is no yearly investment quota. Members invest at their own pace and according to their individual interest and strategy.

Your name will not be shared with the startup automatically but everyone needs to go through a KYC process before investing.

Your name will not appear on the cap table of the startup either. However, we encourage our investors to get in touch with the founders.

Yes, it is possible to transfer your stake to another investor in a secondary transaction. The deal manager must be informed and needs to approve the transaction.

After clicking on “join us” and having completed the form, you receive deals straight to your inbox.

You make your own investment decisions on a deal by deal basis, usually within two weeks after receiving the investment memo.

You can find additional details regarding platform and usage in the application form.

Investors in a syndicate must find a common ground and speak with one voice to the startup.

Yes, members may invest additional amounts in selected start-ups if allocations are available.

Yes, KIID-style summaries are available for syndicate opportunities, outlining key risks and decision-relevant information.

Governance

If a member is affiliated with another fund that may overlap with MEDKAP’s activities, this is disclosed and addressed on a case-by-case basis to avoid conflicts. MEDKAP does not restrict members where they can invest. We assume that there is corresponding approval from the fund/employer.

At the end of each year, the Deal Manager provides the necessary documentation through Leva to support income tax filings in your jurisdiction.

No formal restrictions apply, but first-year members typically focus on familiarizing themselves with the processes and building a portfolio before becoming more involved in MEDKAP.

We expect members to provide feedback on the selected cases and encourage active participation in events and investment decisions.